The new Individual Income Tax law of PRC has come into effective for almost one year, but how to calculate the tax payable still remain a problem, particularly for foreigners working in China.

This post will address some main issues related:

1. A foreigner could be a“resident individuals”

individuals who do not have a domicile in China but have resided in China for 183 days or more cumulatively within a tax year, shall be deemed as resident individuals.

2. How a foreigner pay IIT as a resident individual

1. Where the foreigner resides in China for 183 days or more cumulatively per tax year for less than six consecutive years.

his/her income from all salaries shall be subject to individual income tax, except for the portion of salaries paid by an overseas employer.

2. Where the foreigners resides in China for 183 days or more cumulatively per tax year for more than six consecutive years.

his/her income from salaries derived in China and overseas shall be subject to individual income tax.

3. Computation of tax payable

Tax payable over all comprehensive income shall be subject to individual income tax annually, the formula for computation of tax payable is as follows:

Tax payable for annual comprehensive income = (annual salary – deduction – special deduction – special additional deduction – other deductions determined pursuant to the law) × applicable tax rate – quick deduction.

4. Year-end bonus

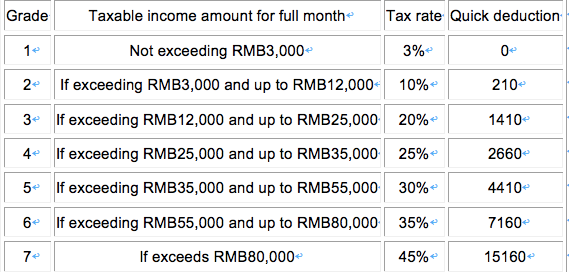

Before 1 January 2022,year-end bonus will not be treated as “comprehensive income” such as salary, or monthly bonus. This bonus shall be apportioned over 12 months for tax computation purpose, with no deduction, and subject to the Monthly Tax Rate Table for computation of tax payable; this tax computation method can only be applied once within a calendar year.

The computation formula shall be as follows :

Tax payable = [ × applicable tax rate – quick deduction] × 12

5. Allowances and subsidies and special additional deduction

Before 1 January 2022, a foreigner may choose to claim deduction for eight allowances and subsidies such as: housing allowance, child education fee, language training fee etc, instead of claiming special additional deduction. After 1 January 2022, only special additional deduction available.

However, for special additional deduction, including children’s education, continuing education, medical treatment for major illness, housing loan interest or housing rent, support for the elderly, will be deducted as per provision.

Quick Computation Chart for Individual Income

| Grade | Annual taxable income | Tax rate (%) | Quick Deduction |

| 1 | Income of RMB 36,000 or less | 3 | 0 |

| 2 | The part of income in excess of RMB 36,000 to 144,000 | 10 | 2520 |

| 3 | The part of income in excess of RMB 144,000 to 300,000 | 20 | 16920 |

| 4 | The part of income in excess of RMB 300,000 to 420,000 | 25 | 31920 |

| 5 | The part of income in excess of RMB 420,000 to 660,000 | 30 | 52920 |

| 6 | The part of income in excess of RMB 660,000 to 960,000 | 35 | 85920 |

| 7 | The part of income in excess of RMB 960,000 | 45 | 181920 |

Example A:

David’s yearly salary: 360000RMB, allowance is 120000RMB, the taxable income is 360000—60000-120000=180000RMB, tax payable=180000*20%-16920=19080RMB

Example B:

David get a year-end bonus, which is 50000RMB,

50000/12=4166.67

Tax payable=(4166.67*10%-210)*12=2103.34RMB

Useful link:

2 Comments.

Are there tax exempts (besides housing allowance) that I can use for tax relief?

Yes, check our recent article “Updated! Treatment for Non-Resident Taxpayers”, mentioned tax deduction, year end bonus, it’s very clear. Or you can contact us for tax plan service