From 1 January 2022, guardians of infants under the age of 3 years old can claim a fixed amount of 1000 Yuan as expense related to the care of your infant each month as an additional special deduction before paying individual income tax.

In an effort to help taxpayers to understand the policy better, we have prepared the following list of Q & A:

Q1. How to declare the special additional deduction?

A1. The special additional deduction for the care of infant under 3 years old implements the management model of “Deduction will be granted once the declaration is made, related documents may be retained by the taxpayers for future reference”, taxpayers do not need to submit documents to the tax authorities when they declare it.

Q2. What information is needed?

A2. Taxpayers shall fill in the names of their spouses and infants, the types of identity documents (such as resident identity cards, medical certificates of infant’s birth, etc.), the amount of deductions and the proportion of deductions between themselves and their spouses.

In addition, taxpayers need to retain related documents for future reference, such as the birth certificate of the child, etc.

Q3. How should the infant’s information be filled in?

A3. Generally speaking, after the birth of infants, they will be given a “birth certificate” containing their names, dates of birth, parents’ names and other information, and taxpayers can fill in their infants’ information in the “Personal income tax” APP (highly recommended) or “Deduction Information Form” in hard copy. They can select “Birth Medical Certificate” as “the type of certificate”, and fill in the corresponding number and birth time of the infants.

If the infant has been given a resident identity card number, “Resident Identity card” can be selected as “type of certificate “and the ID card number and the birth time of the infant should be filled in.

If the infant holds a Chinese passport, a foreign passport, a Mainland Travel Permit for Hong Kong and Macao Residents, a Mainland Travel Permit for Taiwan Residents and other identity documents, related information also can be used in the APP

For infants who have not yet obtained the above documents, the guardian can also choose “other personal documents” and truthfully fill in the relevant information in the remark column. Related information can be updated timely once the taxpayers obtain the birth certificate or Resident Identity Card number. In case the tax authority contacts the taxpayer to verify relevant information, the taxpayer can submit the copy of certificate or other supporting documents to the tax authority in the APP.

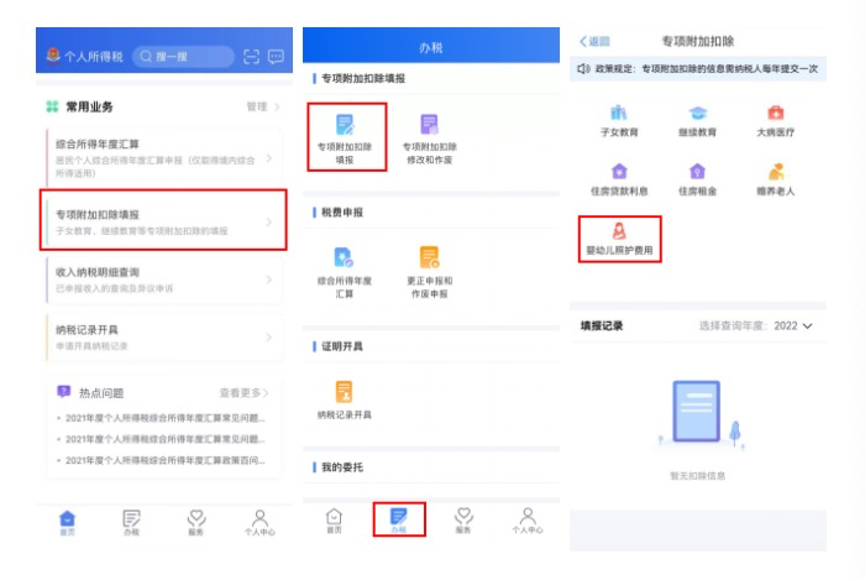

Step by Step instruction on filling:

Q4. Who is entitled to declare the special additional deduction?

A4. The deduction can be declared by the guardians of infants under 3 years old, including biological parents, step parents, adoptive parents, or other people other than parents who serve as guardians of infants under 3 years old.

Q5. What is the scope of infants?

A5. Infants we discussed here include infant born in wedlock, infant born out of wedlock, adopted infant, step-infant, etc. who are under the age of 3 years old.

Q6. Can the parents of infants born abroad enjoy the deduction?

A6. Yes. Whether an infant is born domestically or abroad, the parents of the infant are entitled to the deduction.

Q7. Can the amount of the special additional deduction be distributed between parents?

A7. Yes. There are two methods for parents to declare the deduction: the standard of 1000 yuan per month being declared by one of the parents, or 500 yuan per month being declared by both parents. The parents can choose as they wish. However, once they choose one method, they can’t change it till next tax year.

Q8. Can parents with multiple infants choose different deduction methods for different infants?

A8. Yes. Parents with multiple infants can choose different deduction methods for different infants. That is, for infant A, one party can declare the deduction of 1,000 yuan per month, and for infant B, both parties can choose to declare the deduction of 500 yuan per month.